The Telecom industry is entering a new era of opportunity and uncertainty. At first glance, many would think the industry is entering a golden age of prosperity caused by the explosion of data usage, and the ever-continuing digital transformation of the planet by new use cases and technologies such as the Internet of Things (IoT). But this isn’t the complete picture.

Competition is growing from traditional Telecom providers, as well as external players in adjacent industries expanding their service offerings. Pressures from Over-the-Top (OTT) providers such as Whatsapp, Apple, etc, continues to grow. New disruptive technologies such as SDN, cloud, IoT, blockchain and AI are further threatening the status quo.

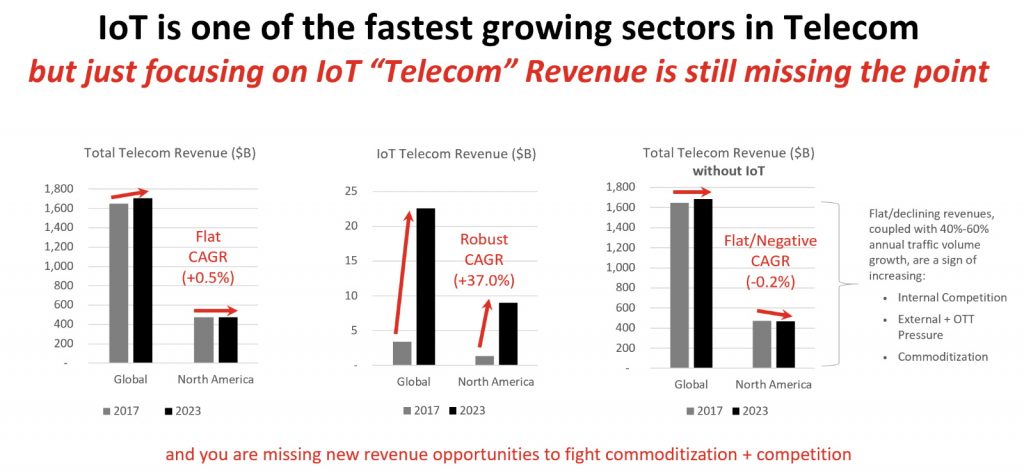

This (im)perfect storm of exponential traffic volume (data, voice, etc) growth of 40% to 60% in many sectors and flat or declining revenue growth indicates the industry is becoming commoditized and is creating a challenging operating environment for Communication Service Providers (CSPs).

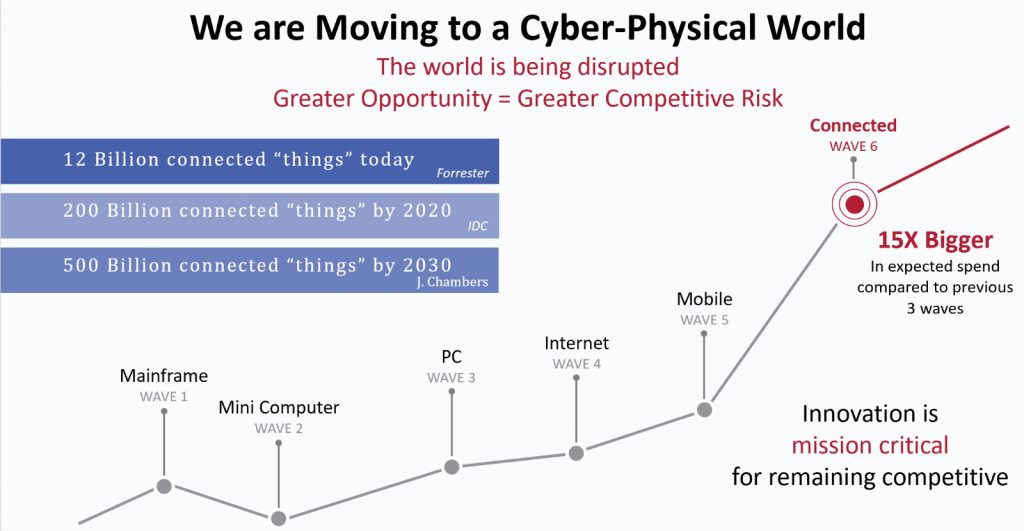

IoT is forecasted to be a significant driver of both usage and revenue streams for the Telecom industry providing growth opportunities for CSPs who plan for it and commoditization of core services for those who fail to respond.

- IoT will drive growth in Telecom.

- Network + Telecom providers need IoT innovation to remain competitive.

- 500 billion – 1 Trillion connected IoT devices are forecasted by 2030.

- IoT spend will be 15x greater than the mobile + internet + PC waves combined.

With hundreds of billions connected devices deployed globally by 2025, Network and Telecommunications providers are in a scramble to re-align their competitive strategies, data services, and network infrastructure to survive and thrive in the brave new world.

According to a recent Market Research Future report, the global IoT Telecom services market was valued at $3.45 billion USD in 2017 and is expected to reach $22.57 billion USD by 2023 with a CAGR of 36.96%. CSPs should rightly target this growth opportunity in their long-term corporate strategy. However, a CSP’s long term growth strategy focusing only on the “traditional and IoT Telecom” revenue opportunities is missing the point… and one of the largest opportunities in a generation.

According to IDC Research and Bain, the overall IoT market opportunity is expected to be $1.2 Trillion dollars by 2022. Only 5% to 15% of this is expected to be Network and Telecom related revenues. This is still a huge market, but only a small sliver of the overall IoT revenue potential.

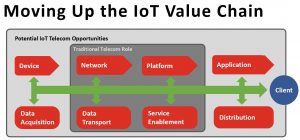

CSP’s need to move outside of their comfort zone and into this emerging IoT space. Telecoms are well positioned to do this by leveraging their core networks, infrastructure, enterprise client base, and expertise. Market share can be captured by Telecom providers who innovate via partnerships with customers, new IoT players, domain specialists, analytic and technology providers to develop and deploy the next generation of IoT networks and services.

CSP’s need to move outside of their comfort zone and into this emerging IoT space. Telecoms are well positioned to do this by leveraging their core networks, infrastructure, enterprise client base, and expertise. Market share can be captured by Telecom providers who innovate via partnerships with customers, new IoT players, domain specialists, analytic and technology providers to develop and deploy the next generation of IoT networks and services.

The winners in the Telecom industry will be those who see this challenge / opportunity, jump into the IoT innovation race, and successfully deliver high-value, scalable data-driven and insight-rich services that focus on cost and convenience while making a positive impact on their customers lives or supply chain.

The key for CSPs is to offer value to their customers, not just connectivity or data. Failure to do this will enable competitors (traditional, external, OTT, and new digital entrants) who provide IoT value services the opportunity (and revenue funding) to win customers and market share in the traditional Telecom markets (data, connectivity, etc). Customers are becoming more demanding and want value, simplicity, and services that make their jobs and lives easier.

Here are two examples:

Smart Building Example

Medical Facility writes off $500k+/year in spoiled, high-end medicines stored in dozens of refrigerators across campus.

- Deployed bespoke sensors + tracking

- IoT Gateway covers entire campus

- Platform provides alerts and insights

- Spoilage reduced to near zero

- Client can pay $X,000’s per month to save $X00,000’s per year

- Client wants to expand use cases

No incremental Telecom revenues used

Smart Agriculture Example

Mid-sized Macadamia Farm wants to improve yield and reduce costs. It is labor intensive to ensure orchards not stressed by drought or over watering.

- Deployed bespoke sensors + tracking

- IoT Gateway (SIM) covers each orchard

- Platform provides alerts, insights and automation

- Savings in labor, electricity and water are realized

- Trees were less stressed = higher yields and nut quality

- Client can pay $X,000’s per month to increase yield by $X00,000’s per year

Minimal incremental Telecom revenues used

In both of these examples, the IoT service provider is able to win clients by offering value with minimal (or no) incremental Telecom revenue used for any local CSP. These illustrate the threat to CSPs in only thinking of IoT myopically in terms of how it will increase “Telecom” revenue. This thinking risks losing clients, further threatening their core business and weakening their competitive capabilities as these IoT providers gain competitiveness, market share and revenues.

In both of these examples, the IoT service provider is able to win clients by offering value with minimal (or no) incremental Telecom revenue used for any local CSP. These illustrate the threat to CSPs in only thinking of IoT myopically in terms of how it will increase “Telecom” revenue. This thinking risks losing clients, further threatening their core business and weakening their competitive capabilities as these IoT providers gain competitiveness, market share and revenues.

CSPs who move up the value chain and embrace these new IoT business models will diversify their revenue streams, complementing their core (data, connectivity, etc.) as it becomes more commoditized, gain market share, and strengthen their competitive position.

CSPs who successfully launch IoT ventures in the near term will be the long-term winners in Telecom (and IoT). New IoT products and services CSPs should consider are:

- Connectivity Technology such as LoRa, LPWAN, NB-IoT, and Radio Frequency,

- Network Management Services such as IoT billing services, device and application services, Install and Integration Services, etc.

- Network Management Solutions such as IoT performance monitoring, network security management, etc

- Advanced Services such as smart buildings, capillary network services, smart agriculture, etc.

CSPs can either develop these new services and capabilities by developing them internally (if they have a corporate innovation center), externally via innovation partnerships (for example with a venture studio), or via strategic acquisitions (M&A).